Defined Benefit Plans

Design Your Own Defined Benefit Plan with MGKS

MGKS has been working with defined benefit plans of all sizes for over 30 years. The actuarial team provides comprehensive and well thought out solutions which are communicated in a way that makes sense to the average plan sponsor. Our industry specific credentials speak to our experience and prove we have the qualifications necessary to administer these plans. Having an actuary in-house is pivotal to any TPA firm managing defined benefit plans given they are required to certify certain attachments to the annual tax form 5500. Each year our team works with our defined benefit plan sponsors to assure the current level of benefit accruals are satisfactory and fit within their budget.

Defined benefit plans can become a burden as they sometimes require certain minimums are funded each year to avoid penalty taxes. We review plan design options annually for the majority of our clients to get ahead of any surprises that may lurk around the corner. If you currently have a defined benefit plan, don’t get stuck with the set and forget approach, and give us a call so we can review your plan and see if there is anything we can change to help the plan accommodate your desired level of funding. On the other hand, if you are looking to start a new defined benefit plan, schedule a consultation today so we can discuss some of the benefits listed below.

- High Funding Potential

- Large Tax Deductions

- Fast Accumulation of Wealth

- Pre-tax Life Insurance Funding

- Many Investment Options

- Customized Allocations

- Understanding the Principles

Company Benefits

(Plan Sponsor)

We understand the importance of accurate and precise communication when it comes to DB plan administration. Most people have a difficult time understanding the principals that govern these types of plans and having MGKS on standby to help navigate those topics will help you sleep at night.

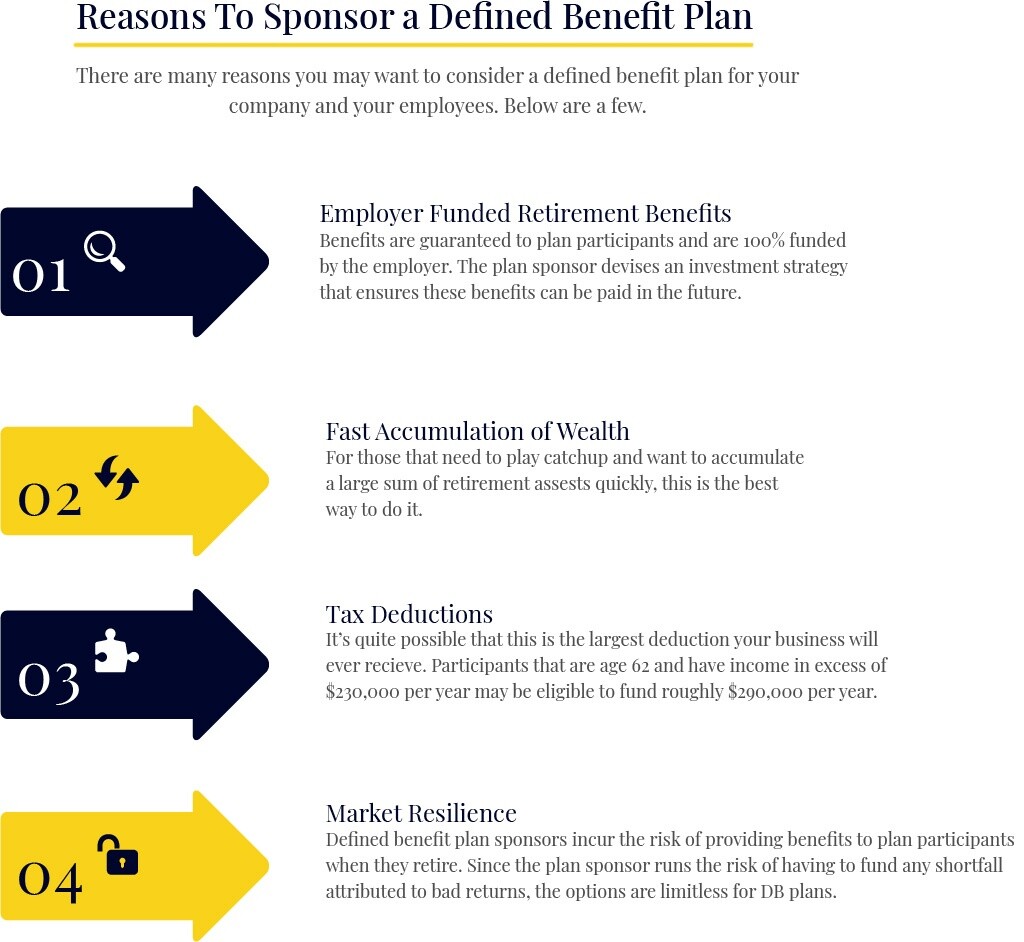

Reasons to Sponsor a Defined Benefit Plan: There are many reasons you may want to consider adopting a defined benefit plan.

- Employer funded retirement benefits – what better way to show your employees you care about their future than by funding a portion of their retirement.

- Fast Accumulation of Wealth – given the funding limitations to these plans are often 3 – 4 times greater than what can be funded elsewhere, assets accumulate quickly.

- Tax Deductions – employer funded contributions result in a dollar for dollar deduction for your business.

- Investment Options – Nontraditional investments such as real estate, LLCs, collectibles, precious metals, and life insurance to name a few can be held inside these plans

Employer Funded Retirement Benefits

- Benefits are guaranteed to plan participants and are 100% funded by the employer. The plan sponsor devises an investment strategy that ensures these benefits can be paid in the future. Employees value the fact that you are funding their retirement which helps you create loyalty and a sense of ownership that translates to increased productivity.

Tax Deductions:

-

It’s quite possible this is the largest deduction your business will ever receive. Participants that are age 62 and have income in excess of $230,000 per year may be eligible to fund roughly $290,000 per year. Don’t just pay it to the IRS, keep it in your pocket or the pockets of your employees.

Investment Options:

- Defined Benefit Plan sponsors incur the risk of providing benefits to plan participants when they retire. As such, the rules about what constitutes a prudent investment tend to be relaxed from what you would see in a 401(k) plan. Since the plan sponsor runs the risk of having to fund any shortfall attributed to bad returns, the options are limitless for DB plans. Take note that certain investments may trigger the unrelated business income tax rules and exotic investments may need the blessing from an ERISA attorney before you move forward.

Participant Benefits

Understanding Participant Benefits in a Defined Benefit Plan

These plans can be designed to target large accruals for the owners and or principals of your business while minimizing employee costs, or they can be designed so everyone accrues equivalent benefits.

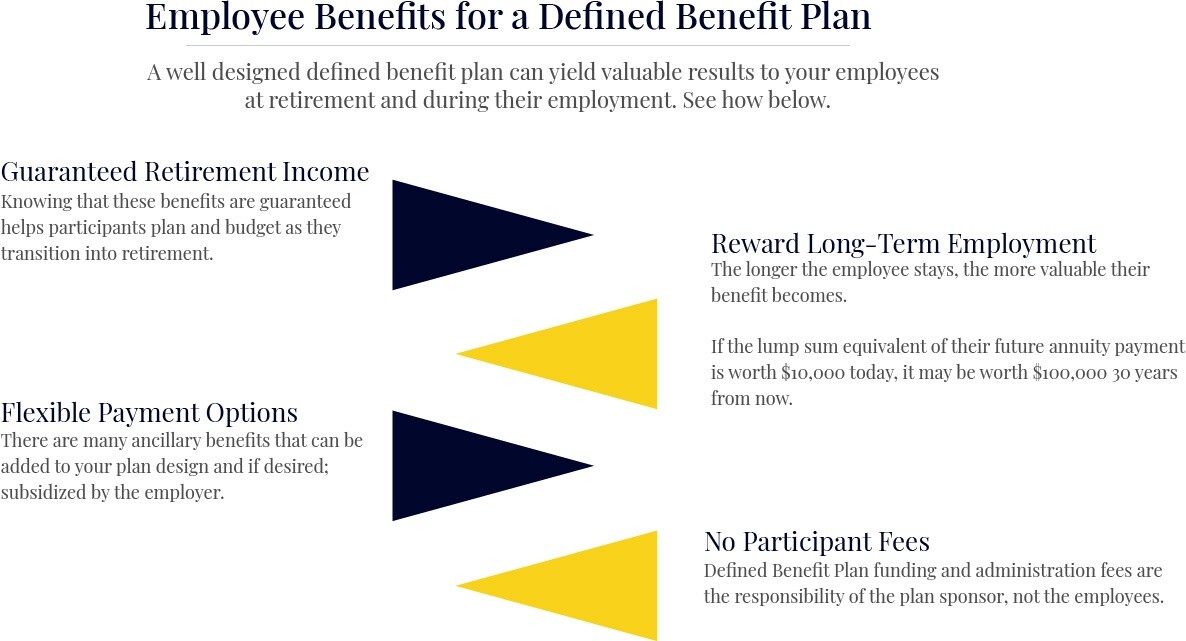

Guaranteed Retirement Income

Employees accrue an annuity benefit stated by the plan which will be payable at retirement and continue for the remainder of their life and sometimes the remainder of their spouse’s life.

Reward Long-Term Employees

Vesting schedules are applied to distributions requested after separation of service. Should a participant leave before they are vested, the non-vested portion of their benefits are forfeited. Given DB plans generally offer sizeable benefits for employees, this discourages them from leaving and creates loyalty.

Joint and Survivor Annuity

If a participant is married and/or has children, certain forms of annuity payments are available to ensure your spouse or secondary beneficiary receives a portion of the annuity in the event of death.

No Participant Fees

Benefits are guaranteed to participants and cannot be reduced for administration fees, contrary to most 401(k) Plans.

Guaranteed Retirement Income:

-

Knowing that these benefits are guaranteed helps participants plan and budget as they transition into retirement.

Reward Long-Term Employees:

- The actuarial principle of the time value of money proves that a dollar today is worth many in the future. The present value of these annuity payments continues to grow as participants age. Thus, if the lump sum equivalent of their future annuity payment is worth $10,000 today, it may be worth $100,000 30 years from now. The longer the employee stays, the more valuable their benefit becomes.

Various Distribution Options:

-

There are many ancillary benefits that can be added to your plan design and, if desired, subsidized by the employer. Participants headed into retirement should discuss the various joint and survivor options with their financial advisor to ensure the right decisions are being made.

No Participant Fees:

-

Not only do the participants not have to fund these plans, they don’t have to pay for them either. Defined Benefit Plan funding and administration fees are the responsibility of the plan sponsor, not the employees.

Tax Benefits

Highly Compensated Employees

-

If you are a business owner or principal earning sizeable take home pay, you are likely writing a big check to the IRS each year. Rather than claiming that all as income and paying the taxes today, put it in a defined benefit plan and pull it out down the road when your tax liabilities are smaller.

Massive Tax Savings

-

Participants at the age of 62 who earn ~ $230,000 per year or more could be eligible for an annual benefit accrual exceeding $250,000. When the employer funds this contribution, the business gets a dollar for dollar tax deduction.

Contributions are Deductible

-

The name of the game is to put it away and let it accrue interest. The interest accrued over the 30-40 years most people work will likely cover any fees you paid to sponsor the plan over its lifetime. If your investment strategy is sound, the interest accumulated on those funds through the years can result in hundreds of thousands of dollars in earnings.

Requirements

Pension plans are not for everyone and you should understand the benefits and pitfalls prior to adopting a plan. Contact us today if you have any concerns or want to look into adopting one of these plans.

Adequate Funding

- Defined Benefit Plans provide definitely determinable benefits and the plan assets must be sufficient enough to cover those benefits at any given time. Should there be a shortfall, the IRS requires the employer to fund installments which create required minimum contributions if the plan is underfunded. Unpaid minimum funding is subject to a 10% penalty tax and the installment remains due in the future which can snowball quickly. Making sure your plan is adequately funded and making sure your investment strategy is designed to go with the plan’s actuarial assumptions is very important.

Employer Bears Cost

-

All fees for annual administration, distributions, loans, amendments, PBGC premium payments etc. are 100% paid by the employer. It’s a free program for your participants.

Actuarial Valuation Reports and Compliance Testing:

-

Each year pension professionals and actuaries will perform the actuarial valuation report and compliance testing, which takes a snapshot of your plan assets at year end and compares them to the benefits owed to plan participants. This calculation determines the minimum and maximum funding range for the year and once funded, our actuaries will report the contributions to the IRS on tax form 5500 while certifying the Schedule SB to confirm all minimum funding has been met and that the plan is in compliance.